Key players in the pulp and paper industry met in London last week amid a recovery in pulp prices in China, with the market facing upside risks for the first time in more than a year. Strong seasonal growth in Chinese demand in the second half of the year, coupled with replenishment-related purchases, has driven net pulp prices in China higher than in Europe or North America. While few players doubt that near-term upward momentum is building in the Western Hemisphere, there are questions about whether China's rally can be sustained as the strength of seasonal demand is likely to weaken towards the end of the year.

Here is a summary of three key discussion points and what they mean for the pulp market in 2024:

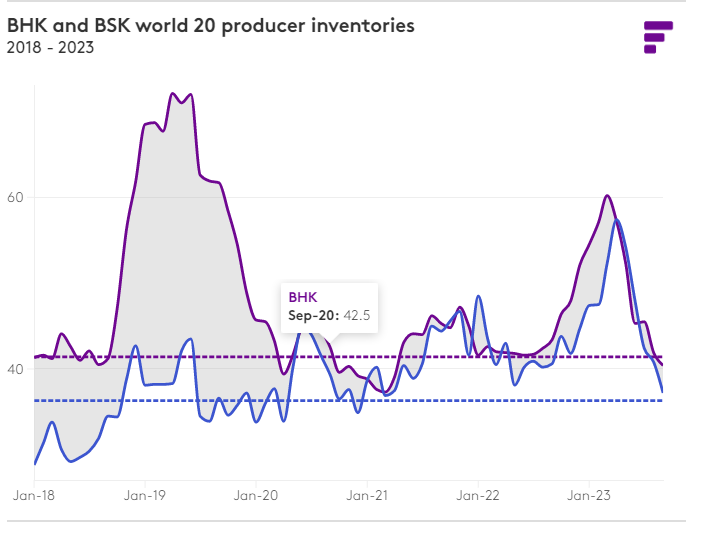

Pulp Market, Chinese Demand Surges: Pulp producers’ inventories have risen sharply over the past year, with bleached softwood kraft (BSK) producers’ inventories hitting record highs before falling in Q2 and Q3 to 9 The month returns to equilibrium. The producer relied on two market components to achieve this feat in just 6 months.

On the demand side, shipments to China surged as domestic consumption picked up and buyers began to replenish inventories, while pulp was relatively cheap. On the supply side, pulp producers suspended more than 1.4 million tons of production due to market reasons throughout the year. The combination of increased shipments and supply has allowed producer inventories to decline relatively quickly and essentially eliminated excess inventory from the market.

Capacity Closures Impact Pulp Market: Permanent and indefinite capacity closures have also impacted the supply side of the softwood pulp market throughout the year, including six market pulp lines in North America and one mill in Finland, which together cut the northern The region has a commercial pulp production capacity of 1.6 million tons. Bleached softwood kraft (NBSK), Southern bleached softwood kraft (SBSK), unbleached softwood kraft (UKP) and softwood fluff pulp markets.

The primary reasons for the mill closures are the result of long-term and short-term pressures on wood fiber supplies and the advanced technology era of North American pulp assets colliding with a potent combination of high interest rates and the North's five-quarter cyclical recession. Most participants agreed that as long as these factors persist, the risk of further closures remains high; however, a consequence of the closures is the start-up of Metsä Board’s new Kemi plant, which started production in Finland in September has been effectively offset.

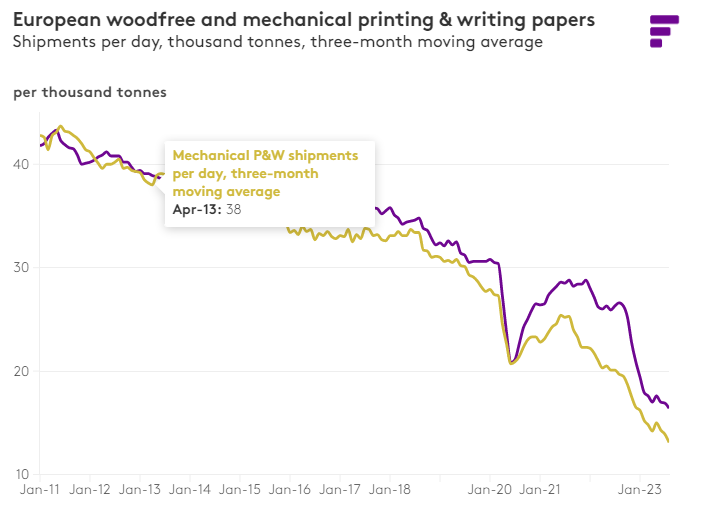

BHK Pulp Market Remains Stable: In contrast, the bleached hardwood kraft (BHK) pulp market has seen relatively few disruptions so far in 2023. Although the capacity base of the BHK market is more than 50% larger than the BSK market, the number of unplanned shutdowns is smaller, and so far, BHK has not announced permanent closure of production capacity in 2023. As global BHK shipments trend upward and BSK shipments trend downward, the substitution pattern continues to play out, indicating that paper and board producers are increasingly looking for ways to make more use of cheaper, lower-cost BHK .

Global Pulp Market Outlook:

Looking ahead to 2024, the global pulp market appears to be entering the new year on a healthier footing. As excess inventory has been cleared from the market in 2023, suppliers may face unexpected disruptions from worker strikes, natural disasters, and/or machinery failures. The current investment cycle in new market pulp capacity is also winding down, with plans to launch a major project next year and another in 2025.High interest rates pose the risk of further closures of distressed assets, while also remaining a barrier to new project development. Despite successful supply management in 2023 and tightening supply conditions in 2024, there are upside risks that pulp producers will still be unable to produce the missing important component - demand.With recent seasonal weakening of demand in China and remaining subdued indicators in Europe and North America, the industry now expects a situation in late 2024 that has not been seen since the outbreak - synchronized demand from Europe, North America, Eastern Europe and Asia increase.